- WAGMI

- Posts

- Market Update Week 10 2024

Market Update Week 10 2024

The premium weekly crypto market update to grow your portfolio

TLDR: BTC is up but ETH is down. Bitcoin dominance is up. The hot coin we look at this week is AKT.

BTC & ETH Market Update 📈

Crypto is looking up bigly this week, with BTC being up 10.8% and ETH up a whopping 14.1%:

Bitcoin dominance has been increasing over the week, starting at around 48.2%, topping at 51.3% and ending the week at 49.2%. Capital often starts to flow into ETH and other altcoins as the price is increasing for more risk-on assets as well, causing a lower Bitcoin dominance as we have started to see this week.

It’s going to be interesting to see whether this trend will continue in the short term, as capital in crypto tends to flow initially to BTC and then further out on the risk-curve, starting with altcoins like ETH and then into mid- or low-cap coins.

The Bitcoin halving is coming up end of March or beginning of April 2024. If history is any guidance we will continue to see BTC dominance climb up until after Bitcoin halving, whereafter people start to look for higher return moving further on the risk curve entering altcoins. This typically starts with ETH, and then on to mid- and low cap coins. Other coins being moved into are typically “ETH killers” like SOL, AVAX and other other L1s. Yet ETH is still the king amongst altcoins, as price action this week also shows.

With BTC dominance increasing and the ETH price decreasing while BTC price is increasing, the BTC/ETH ratio is trending upwards to 17.56 ETH per BTC, underlining that BTC continues to be king in crypto, but alts like ETH are gaining momentum.

Hot Coin: AKT 🔥

In this week’s newsletter we dive into Akash Network’s token with the ticker: $AKT.

The price action and volume is has been growing consistently, and doesn’t seem to stop any time soon:

What is the project about?

In a nutshell, Akash is a decentralized form of cloud computing, or in other words, a decentralized version of Amazon Web Services (AWS), Microsoft’s Azure, or Google Cloud. AWS, which by far has the largest market share of cloud services, currently supports many Fortune500 companies, from everything including McDonald’s to Ethereum node validators.

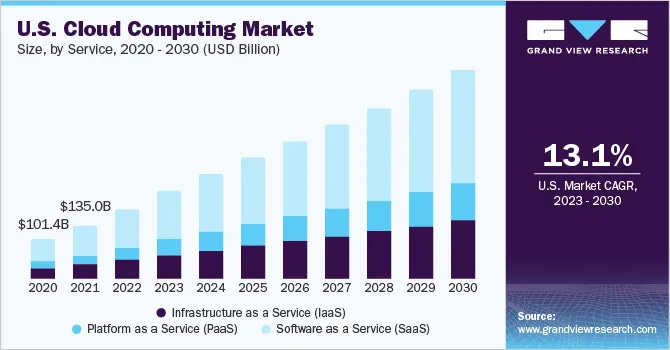

Just to give you an idea of how big the cloud computing market has become, if it wasn’t for AWS then Amazon would struggle to stay profitable post-COVID in 2022:

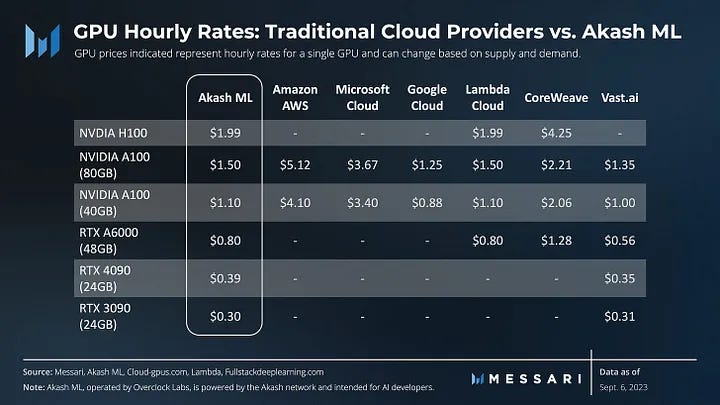

So cloud computing is a massive market with juicy margins that can be attacked by disrupters like Akash. Hence, the potential for new players is large to challenge incumbents with new promising tech such as blockchain. This is exactly what Akash is doing, and they are already getting ahead of these big players when it comes to price:

Essentially, Akash is becoming an unstoppable supercloud enabling users to buy and sell compute resources on a decentralized network, which could become a bigger industry than DeFi itself.

Why is the project exciting now?

There are three main reasons why we feature this project in this week’s newsletter:

Addressable market

Better resource utilisation

Better tech

Addressable Market

Cloud technology is ubiquitous, allowing us to access the majority of internet-connected services nowadays. The importance of Cloud technology cannot be underestimated. It digitalizes the user experience and the way services are provided by eliminating the “need for users to have product-specific hardware so that providers can deliver the same product through the internet”.

To give a perspective of the Cloud Cartel, as of Q4 2022 Amazon AWS, Microsoft Azure, and Google Cloud collectively hold about 65% of the market.

AND, the cloud market is only getting bigger, expecting a CAGR of 13% from 2023 to 2030, especially for Software as a Service.

Thus, it’s challenging for centralized providers to compete with these giants.

Better resource utilisation

According to the network itself, as the world’s first decentralized cloud computing marketplace, Akash leverages 85% of underutilized cloud capacity in 8.4 million data centers. Akash enables anyone to buy and sell cloud computing.

Furthermore, the State of Cloud report published by Flexera estimates the current annual public cloud waste at 28%: roughly one-third of cloud capacity is underutilized (read: wasted).

This better utilisation rate converts into lower prices to customers using Akash to host:

Better tech

No app developer wants to be susceptible to the uptime issues of a centralized entity. Remember in 2021 when an AWS outage halted dYdX activity? On Akash, users can create deployments spanning multiple areas & providers, choosing their desired resources.

Given the recent (and future) “proliferation of LLMs and AI, GPUs are experiencing the highest demand surge in recent history”.

Here’s how Akash compares with traditional cloud providers.

With its “Supercloud”, Akash wishes to solve current industry inefficiencies in GPU distribution:

Users of CSPs are forced to accept permissioned access and the risk of vendor lock-in, and this is only if the desired GPU units are even available.

Highest-performance GPUs prioritized for reserved instances, in which the cloud service provider “pre-sells” or reserves access to specific quantities of GPUs for a predetermined length of time.

Akash addresses these inefficiencies with the first operational Supercloud, a “cloud of clouds,” or a way to permissionlessly access compute resources — including GPUs — from a range of providers, from independent to hyperscale.

Thanks for reading WAGMI!