- WAGMI

- Posts

- Market Update Week 12 2024

Market Update Week 12 2024

The premium weekly crypto market update to grow your portfolio

TLDR: BTC & ETH is down. Bitcoin dominance is stagnant. The hot coin we look at this week is PENDLE.

Latest & Greatest 📰

Before we dive into both current and new airdrops, make sure to check the latest and greatest news across crypto:

Make sure to follow us on X for continuous updates about all things Crypto, Blockchain and Web3.

BTC & ETH Market Update 📈

Crypto is down this week, with BTC being down 6.7% and ETH down a whopping 10.2%:

Bitcoin dominance has pretty much been stagnant over the week, starting at around 49.4%, topping at 50.4% and ending the week at 49.5%. Capital often starts to flow into ETH and other altcoins as the price is increasing for more risk-on assets as well, causing a lower Bitcoin dominance as we have started to see over the course of multiple weeks.

It’s going to be interesting to see whether this trend will continue in the short term, as capital in crypto tends to flow initially to BTC and then further out on the risk-curve, starting with altcoins like ETH and then into mid- or low-cap coins.

The Bitcoin halving is coming up in April 2024. If history is any guidance we will continue to see BTC dominance climb up until after Bitcoin halving, whereafter people start to look for higher return moving further on the risk curve entering altcoins. This typically starts with ETH, and then on to mid- and low cap coins. Other coins being moved into are typically “ETH killers” like SOL, AVAX and other other L1s. Yet ETH is still the king amongst altcoins, as price action this week also shows.

With BTC dominance increasing and the ETH price decreasing while BTC price is increasing, the BTC/ETH ratio is trending upwards to 19.28 ETH per BTC, underlining that BTC continues to be king in crypto, but alts like ETH are gaining momentum.

For deeper insights and updates on Bitcoin and Ethereum, make sure to subscribe to premium newsletter.

Hot Coin: PENDLE 🔥

In this week’s newsletter we dive into PendleFi’s token with the ticker: PENDLE.

The price action and volume is has been growing consistently, and doesn’t seem to stop any time soon:

What is the project about?

Pendle Finance provides decentralized financial services with a focus on fixed yields and yield tokenization. It supports cross-chain compatibility and includes automated market-making mechanisms for effective yield trading.

Pendle was launched in June 2021 as a yield-aggregating protocol, that incentivizes the pooling of yield-generating tokens and the creation of yield markets across DeFi platforms. It allows holders of these tokens to mint them into YT and OT . Holders of yield-generating tokens can sell their rights to yield (Mint + Sell YT), allowing them to lock in their profits and receive upfront cash. Buyers of these rights (Buy YT) gain exposure to the fluctuating rates in a more capital-efficient manner as they do not need to purchase and stake the core underlying asset. As such, there is no need to worry about collateralization or liquidation risk.

Pendle is currently live on Ethereum and Avalanche. On Ethereum, Pendle supports Compound, Aave and Sushiswap. On Avalanche, Pendle supports Trader Joe and BENQI.

Why is the project exciting now?

There are three main reasons why we feature this project in this week’s newsletter and look at it as an attractive buy right now:

Superior Yield

Growing Volume & TVL

Value Accrual

Superior Yield

Pendle continues to be an excellent tool for producing multiple routes to huge profit:

Additional to the yield trading competition they're doing an Arbitrum mega week with up to 400k in $ARB up for grabs in the Pendle Arbi campaign

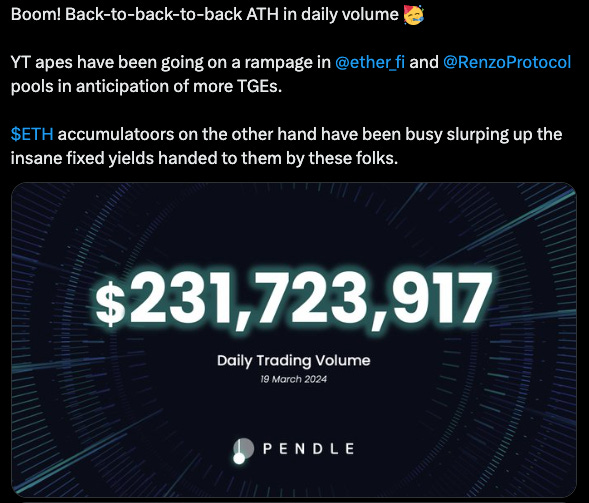

Back-to-back ATH in trading volume since EtherFi $ETHFI launched

Huge volumes are coming from users switching between pools with the aim to optimising their airdrops (http://analytics.pendle.finance) EtherFi airdrop netted many between 5 to 6 digits

LRT narrative still not reached it's peak and tons of opportunities for the next big drop with Kelp, Renzo, Bedrock, Puffer and Swell

Up to 70x in points farming assets like rsETH on Arbitrum

Keep an eye out for Pendle launching another 4 pools soon (and if a new big LRT pops up, highly likely it'll be on Pendle sooon)

Growing Volume & TVL

On the back of superior yield generated when using the Pendle Protocol, Pendle continues to break their own records in daily volume

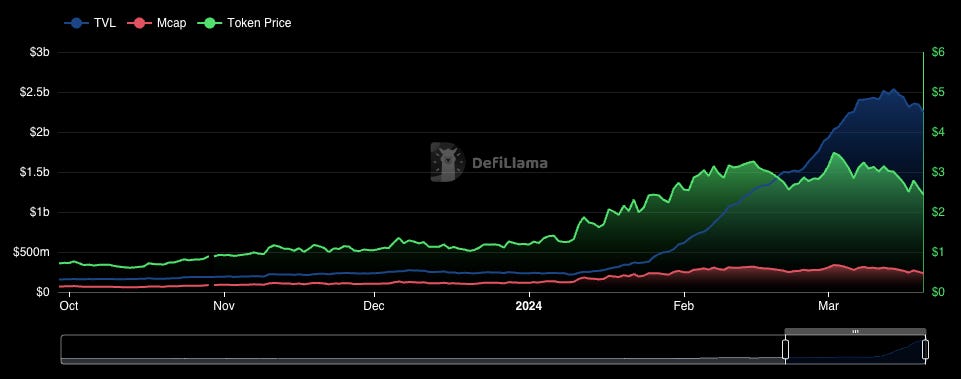

This has translated into a higher PENDLE token price and hence market cap, but check out the disconnect from the parabolic curve for TVL:

Value Accrual

You might ask: Why is TVL and volume so important to the PENDLE token price?

Well, 100% of fees generated on the Pendle protocol are revenue since at this point the protocol does not contribute any fees to a treasury.

This means for every $1 of Pendle you purchase, you are earning $0.002 per year which is an awful return on investment.

Compare Pendle’s FDV/Fee ratio of 442 with GMX’s 7 and CVX’s 6.5. With such a sky-high valuation you should only buy Pendle if you believe its fees will increase significantly over time or as a trader you believe you have an edge in the market.

Pendle’s fees can increase in two ways:

Either the usage of the platform increases or

Pendle’s take rate increases.

Let’s evaluate both from a bull case point of view:

According to the Bank for International Settlements, the TradFi interest rate derivatives market is worth over $400T, roughly 75% of which has a central counterparty (such as the US Federal Reserve or European Central Bank). The potential TAM is so large that Pendle could 10,000x its TVL of $166M and still only own 0.4% of the market.

One of the major narratives and trends in Crypto is the tokenization and financialization of everything. As the amount of on-chain yield products grows, it is plausible that the demand for trading derivatives of these interest rates would increase as well.

Additionally, there are few sources of fixed yield on-chain. In the future, when businesses are managing their finances, they may want to purchase fixed interest rates so they can better plan their business. Pendle can step in to enable guaranteed fixed yields.

Pendle could also increase its current fees. Most notably, Pendle only takes 3% of the yield on the platform. This is significantly lower than its competitors. For example: Convex takes 17%, Rocket Pool takes 14%, and Lido and Frax take 10%. If Pendle were to increase its take rate to match Lido, it would immediately 3.33x its fee generation from yields.

An additional source of fees could come from bribing. Pendle has a very similar locked voting structure to Convex. One significant source of revenue for Convex and Curve is bribing gauge voters. Protocols will bribe CVX holders to increase emissions for their liquidity pools and thus increase liquidity. Increased liquidity on Pendle could lead to additional demand for the token as users purchase tokens to deposit into liquidity pools and earn a higher yield. Increased liquidity in Pendle pools could also stabilize yields thanks to a more liquid interest rate derivatives market.

Beyond that, Pendle has some of the best UI in DeFi. Their site is clean, easy to use, and fast.

From a Tokenomics perspective, emissions are high, but they will asymptotically approach 2% which is relatively low. Unlocks are also complete so there are no VCs with 100x returns waiting for exit liquidity.